Many Singaporean consumers have shifted their purchasing behavior from offline to online shopping as a result of the COVID-19 pandemic, and experts predict that this shift will be a long-lasting one with effects long past the outbreak.

Read more……

Many Singaporean consumers have shifted their purchasing behavior from offline to online shopping as a result of the COVID-19 pandemic, and experts predict that this shift will be a long-lasting one with effects long past the outbreak.

Read more……

Singapore, also known as the Lion City, is an extremely attractive Asian market which imports more than 90% of its food from producers from more than 160 countries worldwide.

Best Food Importers recently published tips for exporting in Asia’s most competitive economy.

The city state’s population of around 5.6 million benefits from a very diverse supply of food, thanks mostly to the Government’s successful policies that encouraged the development of partnerships with a wide range of countries that export food. Recently, for example, Singapore’s Agri-food and Veterinary Authority (AVA) organised a number of trade missions which led to imports of fresh fruit from producers from Central Europe and South Africa or meat from Denmark.

The country is actively looking to diversify and solidify the internal food supply, opening the road for food exporters from other parts of the world who are willing to focus on working with food importers and retailers from Singapore.

The retailer option

Initiating talks with some of Singapore’s main food retailers – Dairy Farm International (Cold Storage, Giant), Sheng Siong Group or Fairprice can be a good initial strategy for market entry. The retailers often act as direct importers, especially for larger volumes of products, which have long shelf life. They sometimes also have representatives who take part in trade missions or visit industry specific fairs, looking for new product lines and niche items.

Working with food importers and distributors is another approach, and companies are advised to try to focus on one solid partnership that can develop long-term, considering Singapore’s relatively small size.

Main imports

Food has a very important role in the life of many Singaporeans and the diverse ethnic mix in the city state has also created an amazing food culture. Meat, especially pork is present in a large number of dishes, as well as fish. Singapore imports most of its fish and seafood from the region, from Indonesia, Thailand or Malaysia, while pork is imported from 29 countries which are currently approved by AVA. Countries like Canada, the US, Brazil or the Netherlands are among the top exporters. Australia is also one of Singapore’s main trade partners for a variety of food items, including meat, dairy, vegetables, processed as well as organic foods.

Fruits like watermelons, bananas or oranges are mainly imported from Malaysia, China and the USA, while the top sources of vegetables are again Malaysia, China and Australia.

The country’s slowly ageing population has also increased the demand for ready meals, easy to cook and other convenience foods.

One of the most-severely hit industries by local lockdowns during the COVID-19 pandemic has been the food & beverage (F&B) industry. Restaurants have been limited to providing takeout and delivery, but largely miss out on lucrative in-house drink sales.

In Singapore, one of the biggest supplier brands to be directly affected by this is Asia-Pacific Breweries’ (APB) Tiger Beer. While Tiger’s own sales may be hurting, it realised its customers needed even more support and quickly moblised a campaign to support local stores and restaurants.

In an interview with Campaign Asia-Pacific, Maud Meijboom-van Wel, brand director of Tiger Beer and Heineken APAC, discusses how the beer makers plan to come out of the crisis as “brands that really contributed and realised something for the greater good”.

What has been the impact of COVID-19 on your ability to market Tiger Beer and Heineken effectively in APAC? And how much do you rely on OOH and F&B locations for brand signage and hyperlocal marketing versus other marketing or media initiatives?

Under normal circumstances, we market our beers using a mix of ATL and BTL advertising that includes digital, TV, OOH and sponsorships. The impact of COVID-19 has made us revise this mix on a market-by-market basis. Depending on what stage of the crisis a market is in, consumers are changing their consumption and purchase behaviours, and this is especially true in markets under some form of lockdown. To maximise reach and relevance, at Heineken we continuously adapt our media and BTL strategy based on that. In general, for markets in lockdown or with limited movement allowed, OOH is stopped, whilst we increase efforts on digital, social and TV.

What is very concerning to us is that because of the circuit breaker or lockdown measures, the business impact on our local pubs, restaurants, coffee shops and food courts is severe. These are our customers and they make our streets the lifeblood of every community.

With Tiger Beer, we started the #SupportOurStreets initiative across Asia to help these F&B businesses tide over these difficult times. It is also a call to people to rally behind their favourite local food outlets as a show of support and to stimulate people to go out to these outlets with family and friends once this is allowed again after safe distancing measures are over.

With Heineken, we have launched many different assets under #SocialiseReponsibly to engage with our consumers and customers across the globe. With so many of us are under some form of a lockdown, we encourage people to look at being apart as just another way of being together.

How are you measuring effects on brand awareness? Is one brand (Tiger vs. Heineken) affected more than the other?

We track our brands on an ongoing basis through our internal monitoring tools as well as looking at usual sensors – including website traffic, media value earned, share of voice, to social media engagement, among others.

Since the onset of the pandemic, our focus has been to make a difference. Simply continuing with marketing campaigns we had or were coming up with would not have resulted in creating meaningfulness. We don’t want to come out of the crisis as brands that do great communication.

We want to come out of the crisis as brands that really contributed and realised something for the greater good. Whether that is supporting F&B businesses or creating awareness in the community through initiatives like #SupportOurStreets and #SocialiseResponsibly.

We very rapidly worked with our agencies to create content that would build that engagement, and create awareness, togetherness and support. We are already seeing a lot of very positive engagement as a result and continue to track how brand awareness has and will affect our brands.

Many brands are shifting to digital to reach consumers in their homes. How has your digital strategy altered?

This pandemic, like other recent crises, has been a booster for digital transformation. We were well-placed to ride this change as digital has been an important part of our marketing strategy globally as well as in APAC for many years already.

Now, more than ever before, people are looking for digital content that cheers them up, that creates a sense of community and togetherness, and that entertains them and puts a smile on their face. We are creating assets that aim to do just that, dependent on audience and market.

Globally, through #SocialiseResponsibly, we launched Ode to Close, a beautiful film that reflects what people are feeling, and that drives home the message that even though we are apart, we can still feel together. In Vietnam, we launched assets around uncaging positivity which resulted in a lot of engagement and a reach of over 30 million.

Running global campaigns and allowing markets to create relevant and targeted ‘local top-spin’ works well. It captures the spirit of our brands in a very local context. It is imperative that we also continue to develop a clear view of how consumer needs and behaviours are changing as we emerge from this crisis and that we develop a clear perspective of our brand’s longer-term digital future in response to that.

To what extent have purpose and community initiatives become more important to Tiger across Asia?

During times of stress and uncertainty, consumers tend to revert their focus on local communities, and this is even more true in this era of lockdowns and restrictions of movement. Such times also call for brands to contribute strongly to community well-being ahead of commercial and corporate considerations.

This thinking in fact inspired and informed our latest #SupportOurStreets campaign which aims to build a sense of community in two ways. Firstly, in line with local governments’ communication, it reminds, urges, and incentivises people to stay off the streets and stay home for the greater wellbeing and health of the community. Secondly, it calls on people to stand together and support local F&B businesses who are now strained like never before.

But even before the outbreak of the global pandemic, we always believed it is our duty as a brand to engage with and give back to the community in different ways. For years now – even before this latest campaign to support local F&B businesses – we have hosted Tiger Street Food Festivals around the region and have been raising money for the Tiger Street Food Support Fund in Singapore. Our Tiger Roar Community is a platform that supports undiscovered creative talents in art, music dance, food, and fashion to give them tangible opportunities that lets them showcase and bring to life their craft.

What response have you had from the #SupportOurStreets campaign? How has this compared to expectations?

#SupportOurStreets is a campaign that seeks to support local pubs, restaurants, hawkers, coffee shops and food courts tide over these difficult times, and to date, more than €950,000 has been pledged in Malaysia (MYR1.5 million) and Singapore (SGD1 million).

We are seeing support of this initiative by both the F&B community and the public. In Vietnam, consumer engagement hit tens of millions. This bodes well for the campaign’s expansion to Cambodia and Thailand in the coming weeks. We are excited to see this movement grow across the region and more importantly, to be able to help local F&B businesses who are struggling now. How fluid are your future marketing plans given how dependent you might be on government directives and the shape of economic recovery? We strictly abide by governments’ laws and regulations and will continue to do so. This is especially important when these directives save lives. As for future marketing plans, COVID-19 requires forward-thinking, new strategies and re-planning. We are full of optimism though. We will come out of this one day and we will come out stronger.

Source: Campaign Asia-Pacific

Source : https://www.campaignasia.com/

Read more>>>>>https://www.campaignasia.com/article/locked-out-of-bars-how-heineken-and-tiger-beer-are-adapting-during-covid-19/459765

Saheli Roy Choudhury of CNBC recently published that Southeast Asia’s e-commerce giant Lazada said its online grocery sales in Singapore jumped four times from early April — since the city-state introduced movement restrictions as the number of coronavirus cases intensified.

The Alibaba-owned firm has about 65 million active consumers on its platforms across six different Southeast Asian markets. Lazada’s online supermarket delivery business in Singapore is RedMart, which it acquired in November 2016.

RedMart’s unique visitors on a daily basis have increased more than 11 times, according to Lazada Singapore CEO James Chang. He told CNBC’s “Squawk Box” on Tuesday the company had a “pretty tough time” trying to keep up with the services customers expected during the peak period.

″(RedMart’s) sales have increased about four times in this space and we hired about 500 staff here in Singapore over the course of a few weeks to be able to increase our capacity substantially,” Chang said. People hired to meet the increase in demand were a mix of full-time staff and part-timers.

Lazada also introduced a new delivery system on April 4 that allowed the company to increase its capacity by 50% and take on more orders as an increasing number of people turned to e-commerce.

When the infection was beginning to spread rapidly outside China in February, Chang told CNBC at that time that RedMart’s orders jumped and exceeded its weekly average by 300% when people in Singapore rushed to buy in bulk.

Lazada has “a huge investment” in information technology and logistics infrastructure, Chang said Tuesday.

In Singapore, the company is opening up a warehouse called the “West Fulfilment Centre” that would have several automated areas designed to meet customer needs. It is expected to be unveiled in July or August, depending on how well the outbreak is contained.

The company declined to reveal any dollar-figure in terms of its investment commitments in Singapore but said that it is “ongoing.”

Singapore has one of the highest numbers of coronavirus cases in Asia, and reported more than 35,000 cases of infections.

To slow the spread of infection, Singapore imposed strict restrictions in early April, which authorities called a “circuit breaker.” Those measures are on course to gradually ease in three phases. Starting Tuesday, the first phase went into effect where more people were allowed to return to work, but remote work were expected to be the norm.

With Singapore in a coronavirus lockdown until May 4 and more than three-fourths of the workforce working from home, supermarkets are seeing a spurt in sales. As consumption shifts from workplaces and schools to homes, shopping for food and groceries are on the rise.

Thanks to this surge, supermarket moguls Lim Hock Chee and his two brothers Lim Hock Eng and Lim Hock Leng, who jointly own a 57% stake in Sheng Siong—Singapore’s third-largest supermarket chain after NTUC FairPrice and Dairy Farm International—have seen their combined fortune touch $1 billion for the first time. Shares of Singapore-listed Sheng Siong rose 39% since its March 19 low, owing to uncertainty stemming from the coronavirus pandemic.

Sheng Siong, which sells everything from fresh produce and grocery to toiletries, operates 61 supermarkets across the island nation. Anticipating supply chain disruptions as a result of the pandemic, Sheng Siong moved quickly to increase inventory as per its annual report released in February.

Supermarket sales in Singapore grew 15.5% year-over-year and 15.4% month-over-month in February as Singapore raised its alert level to orange on the Disease Outbreak Response System Condition, indicating that the “disease is severe and spreads easily from person to person.”

In an April report, DBS, which has a “buy” recommendation on Sheng Siong, said that “as people are encouraged to stay home as far as possible, we expect retail spending on food staples to strengthen further.”

“We see a stronger shift of food consumption at workplaces and schools to homes during the next month,” the report added. “This will result in brisk sales at grocery retailers, food and beverage foodservice outlets near residential areas, and online channels.”

RHB Bank analyst Juliana Cai made a similar prediction, stating in an April report that supermarket sales will remain strong even after May 4, when the lockdown ends. “While residents may rush to dine out after four weeks of ‘cabin fever,’ we believe the increased proportion of employees working from home versus the norm should keep supermarket sales resilient,” she said in the report.

But Cai added that a prolonged lockdown “may further increase input costs or cause food shortages.”

Hock Chee himself had cautioned shareholders in the company’s annual report released on February 22 that COVID-19 “might disrupt the supply chain and result in higher input prices which will eventually affect the group’s gross margin if these additional costs could not be passed to the customers.”

Sheng Siong, which has 18 house brands across 1,200 products, reported 2019 revenues of $737 million and net income of $56 million. While Singapore’s supermarket sector grew only 0.3% in 2019, Sheng Siong’s revenues were up 11.3% over the past year.

Family Business

Sheng Siong was founded in 1985 by the three brothers. They grew up on a pig farm in Punggol—a fishing village in north-eastern Singapore which was originally focused on poultry farming and pig-rearing but is now a residential town. They gravitated to the supermarket business after the Singapore government phased out hog farms in the 1980s.

The family are hands-on when it comes to running the business and the brothers have clearly defined roles. Eldest sibling Hock Eng, who is the executive chairman, oversees the opening of new stores; while Hock Chee supervises the meat business. Youngest brother Hock Leng, who is the managing director, handles the seafood business.

Two of their wives are also involved in the family trade: Hock Chee’s wife, Lee Moi Hong, is a director and head of dry goods. She supervises the packing and distribution of everything from biscuits to flour to Chinese herbs. Hock Eng’s wife, Tan Bee Loo, is also a director and oversees the fruits and vegetables division, handling everything from import to pricing to quality control.

The brothers are grooming the next generation: chairman Hock Eng’s daughter, Lin Ruiwen, is an executive director; Hock Leng’s son, Nigel Lin Junlin is executive assistant to his uncle, Hock Chee.

In its first overseas expansion, Sheng Siong opened a store in China in 2017 and followed it up with another in 2019.

The Lims have ambitions beyond groceries. The family—through its privately-held Sheng Siong Holdings—is part of a consortium that has applied for a digital banking licence, led by fellow Singaporean rich lister Min-Liang Tan’s gaming hardware maker Razer.

This article recently published by Anu Raghunathan a contributing editor of Forbes Asia.

Jessica (Cellar.asia) is a wine specialist based in Tuscany recently published Singapore Wine Industry: The insider’s picture

The Singaporean wine sector is highly developed and competitive, and according to the ProWein Business Report 2019, Singapore is the number one emerging market for producers to enter over the next five years.

Six Southeast Asian countries claimed the top 10 as emerging sales markets for producers and exporters, Vietnam (5th, 21%), Thailand (7th, 15%), Malaysia (8th, 12%), Philippines (9th, 11%), and Indonesia (10th, 10%) are all represented.

With Singapore positioned as the gateway to the Southeast Asian wine business, this modern city-state is an exciting market opportunity to investigate.

Singapore does not produce any of its wine and is an import reliant market. This wine industry is driven by powerful consumer spending and intense urbanization.

The high disposable income of locals drives the appeal for premium wine. Singaporeans are some of Asia’s biggest spenders on eating and drinking out, therefore Singapore’s trade policies are focused on ensuring a steady supply of high-quality foreign wine into the market.

International winemakers control a significant share of the market in Singapore, capitalizing on the lack of domestic winemakers in the nation.

Singapore is a multicultural country with English as the primary working language and a population of almost 6 million people which is growing quickly.

Circa 74.3% of the inhabitants are Chinese, 13.4% are Malay, and 9% are Indian (2017 est.).

The whole Southeast Asian region is made up of around 40 % of practicing Muslims, which makes the industry difficult to penetrate, this means that growth is limited to three consumer profiles: visitors, expatriates, and the other 60% of the Southeast Asian population.

Singapore is the top emerging market of choice for international wine exporters. One of every two producers from France (49%), Italy (51%), and Spain (45%) list Singapore as their choice of emerging market for 2020. 32% of New World wine exporters also list Singapore as a potential market prospect.

| 1. United States | +1,412 million USD |

| 2. China | +1,145 million USD |

| 3. Germany | +664 million USD |

| 4. France | +570 million USD |

| 5. United Kingdom | +469 million USD |

| 6. Singapore | +312 million USD |

| 7. Italy | +289 million USD |

| 8. Belgium | +246 million USD |

| 9. Poland | +219 million USD |

| 10. Netherlands | +169 million USD |

| 11. Hong Kong | +161 million USD |

| 12. Sweden | +160 million USD |

| 13. South Korea | +148 million USD |

| 14. Denmark | +146 million USD |

| 15. Ukraine | +117 million USD |

Average annual growth 2018/2017: +8%

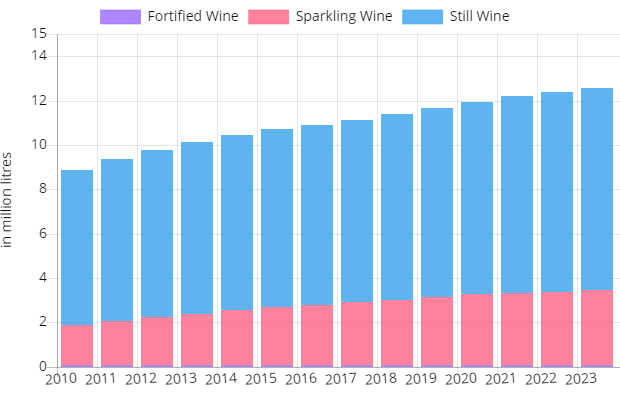

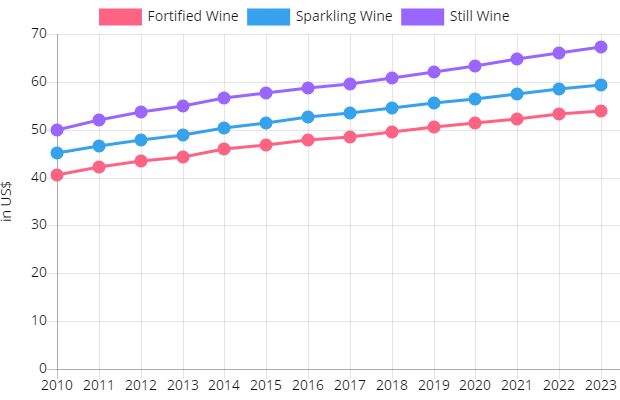

By 2021, if Prowein’s estimations are correct, the wine market in Singapore will reach a market value of US$1.4 billion, registering an average wine consumption of four bottles per capita.

Currently the average consumption of wine per capita in Singapore today is around 2 liters, which equals two and a half bottles. By 2021, that number should reach almost four bottles.

France dominates the premium wine market, closely followed by Australian wines and Chilean wines.

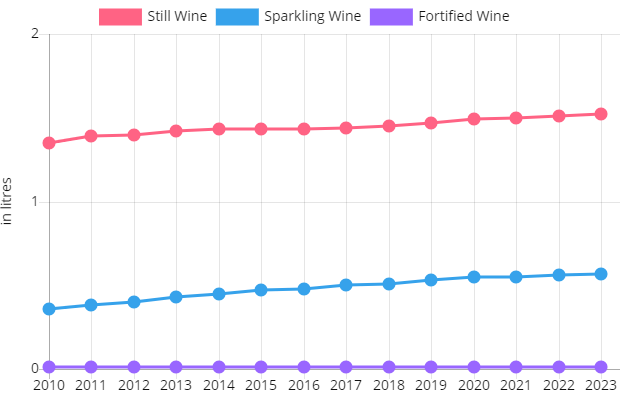

Still wine is the most popular wine imported into Singapore, followed by sparkling. Prosecco is rising in popularity as consumers look for a cost-friendly alternative to French Champagne. Singaporean wine consumers are knowledgeable and willing to try new tastes.

The top five brands of still wine in Singapore are all Australian wine brands. They include Jacob’s Creek; the biggest brand in terms of overall wine volume sales.

The fortified wine category registered the slowest value growth. This sector is expected to grow at a lower CAGR of 3.2% from 2016 to 2021. Consumers within this category are less likely to trade-up to premium offerings, so manufacturers charging premium prices will need to thoroughly justify it to the consumer.

The average price per unit of wine is US $61.49 for still wine and $56.50 for sparkling wine.

Market growth is likely to come first and foremost from online wine merchants.

Data from research agency Euromonitor International found that Internet retail continued to be the fastest-growing off-trade channel for wine in Singapore in 2017. It also predicted the trend is likely to remain with major online retailers likely to appeal to a tech-friendly consumer base seeking competitive prices and uncomplicated purchases.

Wine bars are popular with expats and visitors and are complemented by Asia’s rising middle-class interest and enthusiasm for wine culture and eating out.

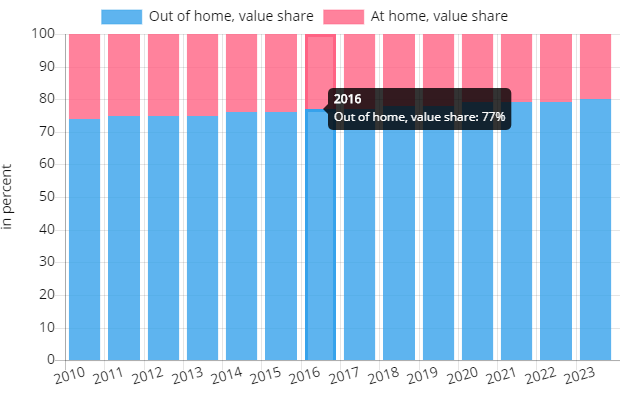

According to Statista, by 2023, 80% of spending in the wine industry will be attributed to out-of-home consumption.

Despite many wine specialists touting Singapore as an emerging wine player, it is also a very tight and cutthroat market. The consumer base is limited, and there are already many well-known importers, suppliers, and sellers with excellent reputations.

Singaporeans are loyal and cautious towards exploring replacements to their usual wine preferences. They enjoy new products, but also stay faithful to well-known brands and like to experiment with new products only after feeling guaranteed of their quality and origin.

Singapore imposes heavy taxation on alcoholic beverages, otherwise known as the ‘sin’ tax. Marketing of wine is restricted, and alcohol advertisements are not permitted to be shown during programs intended for young people or during Malay-language tv shows.

Singapore is home to the Southeast Asian region’s largest wine storage vault and is increasingly being regarded as Asia’s most innovative wine hub. By virtue of its strategic location on the world’s major trade routes, Singapore is the world’s busiest container transshipment nucleus and is an exciting gateway into the Southeast Asian wine market for longstanding collectors and new enthusiasts alike.

The country presents significant growth potential due to the mounting trend of accumulating vintage wines which are also assisting the growth of the sector.

Premium consumers from countries such as Myanmar, Vietnam, Laos, China, and South Korea prefer to purchase premium high-end wines from Singapore because they feel that what they purchase in their own markets may not be authentic.

Foreign winemakers should look to take advantage of this premiumization undertaking by introducing luxury premium wine products into the market.

There is a growing demand for healthy and sustainable wine products as the average Singaporean enjoys a high standard of living and is a keen buyer of high-quality products. This is interesting to organic wine producers looking to enter the market.

Singaporean wine consumers are open-minded and have a high disposable income that they are willing to spend on liquid luxury products such as wine.

Pricing should be competitive, as bargaining is commonplace in Southeast Asia.

Singapore is rebranding itself as a sophisticated wine hub for the new decade. This concept fits in very well with the city-state’s strategic location in the center of Southeast Asia and it’s excellent transportation links. Emerging market players should keep in mind factors such as price, quality, and service and remember that the market is both small, and competitive.

Selling wines is not an easy job, now more than ever wineries have to determine consumption trends and master marketing to increase sales. Not only that wineries all over the World are competing against each other, but the consumers are changing as well. That’s why marketing “tricks” have to be in line with new consumer trends.

Result based on examined emerging consumers trends and present top 10 marketing strategies which wineries can use to boost sales.

Marketing is an exchange in which both sides gain.

In the 21st century is all about the individuality. Individuals are in the center and want the highest possible personalization. Creating unique products according to the customer’s needs and desires is essential. Therefore, wineries must become more consumer-centric to win new customers. Winemakers who have already detected that are now – for example offering bottles of wine with the label of customer’s identity.

Adapting the product to the consumer use and needs meets the need for personalization of the consumer.

Consumers are becoming more educated and picky, they make purchase decision only after they gather all the information about the product.

Consumers are becoming more educated and picky, they make purchase decision only after they gather all the information about the product.

The consumer must have an easy access to the information about the product; the price list is a must have. Increased flow of online information enables consumers to quickly verify all the data, and compare products. Transparency applies also on traceability, as well as information on transport and storage.

So many winemakers have started to complement and specified the detailed list of the ingredients used in the production of wine, on their bottles. Since there are a lot of information, and no space on the bottle, make use of “QR code” where you can store all additional information and interesting facts consumers and customers may like to know about the product.

Photo (Shades of Green): Detailed information label on the wine bottle, together with the QR code.

People has always been interested in the background stories, stories hidden behind the product. Because it gives them an opportunity to experience the product on a different level. Today taste, smell, and appearance are not enough, products which evoke special feelings attract consumers. The story, give consumers an opportunity to experience the product on a different “subtle” level.

Story sell the product.

Given the fact that market is full of cheap products, local wineries can offer a unique alternative with their products. Local, high-quality raw materials, careful production, and interesting story are the key to boosting sales. At the moment marketing trends largely revolve around videos. So our advice for wineries would be to invest money in a good video story about vineyard, winemaking process and people behind the wine. And then “pack” the video into QR code on the back of the wine label.

There is no better way to experience wine when you get to know the story behind.

Consumers are in search for a balanced life. While seeking for a personal pleasure they are also interested in their own well-being, and thus the well-being of the whole local community, and the environment that surrounds them. Nowadays product must give the consumer a good, positive feeling – the feeling that their purchase contributes to something or/and someone.

The product which has a positive impact on the consumer health sells better.

As already mentioned consumers do care about the environment. In recent years sells of products which production and processing do not harm the environment to a bigger extent, have increased. Companies that care about the environment, climate change, animal welfare and are oriented towards workers well being, have bigger selling success.

As already mentioned consumers do care about the environment. In recent years sells of products which production and processing do not harm the environment to a bigger extent, have increased. Companies that care about the environment, climate change, animal welfare and are oriented towards workers well being, have bigger selling success.

The same goes for wines, consumers prefer to buy (and are even prepared to pay more) for natural, organic, low sulfite wines. Wineries which production of wines is nature-friendly, use less synthetic pesticides and fertilizers, recycle water, etc., sell more.

Photo: Different labels, which indicates that the product was produced in the environmentally friendly way.

Millennials or the Y-generation was born between 1981 and 2000 – currently ages between 16 and 35. They will soon represent the vast majority of working force in the world and therefore the main consumers. Millennials are the generation that has grown up with the IT technology and are skilled and confident in social networks. Unlike previous generations, the money is not so important to them, they are looking to the future with optimism and hope, appreciate challenges and are socially conscious. They are looking for alternatives in all aspects of their life – work, entertainment, eating, etc. Due to the fact that their consumption just started and will continue to grow over the next years, it makes sense to take a step closer to their needs and wishes now.

Millennials or the Y-generation was born between 1981 and 2000 – currently ages between 16 and 35. They will soon represent the vast majority of working force in the world and therefore the main consumers. Millennials are the generation that has grown up with the IT technology and are skilled and confident in social networks. Unlike previous generations, the money is not so important to them, they are looking to the future with optimism and hope, appreciate challenges and are socially conscious. They are looking for alternatives in all aspects of their life – work, entertainment, eating, etc. Due to the fact that their consumption just started and will continue to grow over the next years, it makes sense to take a step closer to their needs and wishes now.

They are looking for packages suited to their nomadic lifestyles and the size of their wallets. As well as non-conventional wines all across the globe. Wineries, if you want to get closer to Millenials generation you can start by selling wine in smaller bottles (approx. 2 dl), the interesting funky label won’t hurt either. In France and Australia sells of “wine in tubes” which amount is equivalent to one glass of wine, is increasing. That kind of packaging can create added value, and in addition, small bottles are usually sold at a higher price. *We will write more about Millennials and their wine preferences in some other blog post.

Consumers are impatient and want everything immediately. This also applies to the delivery of goods ordered over the Internet. Ordering products through online stores and mobile applications are growing year by year.

Wineries, if possible enable consumers to purchase wine through the online store and take care of a prompt delivery. Recent figures also show that more and more people browse online via mobile phones (this even exceeds the use of computers), so you might consider adjusting web page for browsing on mobile phones and enable a purchase of wine through mobile applications. Consider also the use of mobile applications which are tailoring wine purchase according to consumers needs, preferences, occasions, and meals.

In recent years there is a tendency in the belief that each one of us is special and gifted for something else. While on the other hand consumers feel that there is no variety in market supply – it seems that everyone sells the same things. So in response to that new restaurants and stores are emerging which offer a very small range of products and/or are specialized only for one product and/or segment. Consider whether a large assortment of products is necessary and economically feasible for your winery.

Social medias offer a new possibility of interact. On one hand, it gives companies an opportunity to easily segment consumers according to their personal information and purchase preferences, and enable the fast spread of media messages to a very large number of people. On the other hand, social networks allow consumers to communicate with the companies and verifying each and every information spread. While in “new” wine countries +80% of examined wineries communicate with their customers over social media in Europe the percentage is much lower: France 68%, Germany 34%, Hungary 35%, etc. So this advice goes more for wineries from “old” wine countries to start using social medias to spread their messages, interacts with customers, and most important let potential customer know about you. Include pictures and videos of the current situation of your vineyard, cellar, wines sales, etc. in your posts. Response to customer messages and let them know you are here for them. Social networks, which are currently most used by buyers of wines, as well as wineries, are: facebook, twitter, youtube, Instagram, as well as Pinterest and g +.

Joining Market-oriented Competition is one of the easiest way to get importers and distributors. Join now Singapore Awards 2020 here:

Drinking wine with friends, outside, while good music is playing somewhere behind, now that a blessing. Wineries, get close to your customers and prepare outdoor events or take part in the open events if possible. Yes, yes that’s not a new idea to spread the word and increase the sell, but still a very useful one. On this kind of events, you will be able to present yourself and make another step closer towards your customers and gain a new one. Don’t forget to be bold, use balloons, funny wine glasses, wallpaper, etc.

Sources:

Six tendances pour inspirer le marketing du vin, Vitisphere

Wine Trend Predictions, CORAVIN

Presentation: Rainer Haas; Agrobiznis konferenca

Millennials and wine, thebacklabel

A cross-cultural comparison of social media usage in the wine business http://www.evineyardapp.com/

STRATEGIES AND RECIPES BY CHIARA SOLDATI

How do you see the current situation in general?

“Nothing will be the same as before”…we have been hearing it for weeks; however, the data gathered by Nomisma present a fairly encouraging picture: Italian consumers (85% of the entire population) state to be faithful to their own habits already starting from Phase 2, accordingly with their financial availability. The growth in large retailers does not compensate the stop of consumption outside our homes in the HORECA channel. An investigation of the Vinitaly-Nomisma Wine Monitor Observatory, developed on 1,000 Italian wine consumers, states that for 80% of consumers “after” will be like “before”.

For many the Horeca losses will be penalizing, not compensated by growth in domestic and online consumption, and it will take years to recover. Only in the EU, said OIV, the estimates, with the Horeca sector not working, are about a loss of – 35% in volume and -50% in value for wine. The growth in large-scale distribution, where, however, the offer is much more price-oriented and limited to far fewer players than that of the restaurants industry, are not enough to compensate the overall losses.

The worlds of wine and restaurants are called to profound changes, grappling with the need to react to the financial crisis and at the same time they have to defend themselves from speculation: the forecasts are considering a drop in the overall consumption, and a reduction in average prices, and therefore in margins of sales and turnover. This will have a direct impact on farmers and producers of wine and grapes. We continue to invest in production and we will not give in to speculation.

It is fundamental to maintain jobs, excellence and support the “rural business”. My family has been investing in Gavi for 100 years and will continue to do so, especially now that the company is entering in its 5th generation. Precisely for this reason we are also thinking about strategies and products that look to the future and to the generation of millennials.

How are the foreign markets reacting to the emergency?

We have balanced percentages between export and Internal market (70% and 30%), diversified by sales channels and export development in 46 countries. This allows us to maintain a certain balance. In addition, the selection of valuable international partners like Shaw Ross in the USA combined with SGWS in the distribution, Simple in Russia, Galleon in Canada, Pernord Richard in Estonia, Eurowines in the UK, Ariane Abayan in Germany just to mention some, it is a fundamental guarantee. This does not minimize my concern for what we are experiencing and will have to face, but professionalism and extreme quality will be basic requirements to be competitive.

How do you see the short term future for the Italian food and wine world?

Italy has potential for recovery but if the right actions are implemented. The economic recovery must be made with gradual reopenings, specified plans and medium-term investments. What do you need for Italy and specifically for the food and wine sector? We need a forward-looking policy that rewards courageous entrepreneurship, who knows how to manage transitions and who knows how to train new skills, a policy that simplifies bureaucracy and makes it competitive. The pandemic was a completely unexpected event which is now putting a strain on national economies and also on the balances that had consolidated over the past decades. This situation could be the end of globalization and see a return to nationalisms. Italy is one of the countries that has benefited most from globalization. Technology will push towards greater globalization, nationalisms will slow down the return to expansion. The problem will have to face will be to provide bars and restaurants with health devices and therefore facing new habits. In my opinion, we will continue to witness a development of wine and food delivery.

What do you think of the so-called phase 2? Which “recipe” do you propose?

I hope for a concrete dialogue involving all the social partners and the needs of all economic and productive sectors. It needs an overview with strategies that also look to the medium term. The economic recovery is made of gradual reopenings, strategic planning and medium-term investments, aid to businesses and simplification of bureaucracy. We need new growth, to raise the GDP. Businesses are the main players, but we cannot do it alone, we need a strong modern, leaner audience.

What can be the after-lockdown strategies to relaunch the wine sector?

We must continue investing in marketing activities. Companies that continue to invest on this kind of activities will have many more benefits. We also have to focus on the main brands. In the most complex phases of a crisis it is good to focus on the markets that we are able to better manage, where, in the most recent past, we have been able to generate the best profits. In addition, the well-known and consolidated brands will be more successful, brands on which the investment to create visibility by importers / distributors / traders will be less expensive. We must focus on innovation. In times of crisis it is natural to think about what could be useful innovations to allow companies to improve their situation. They are in fact the phases where we think about the so-called NPD (new product development). It is certainly positive to think about how to innovate ourselves. We should avoid promotional discounts. Discounts and promotions in general are always a delicate issue. La Scolca will handle this issue with great caution because lowering prices beyond a certain threshold today means risking medium and longterm profitability, as well as an impoverishment of product quality in the event of lower quality standards. La Scolca is doing the opposite, so continuing to invest in quality and in the search for ever higher production standards. The illusion that lowering the positioning today can be easily raised tomorrow is an illusion.

Local is better. The “local” factor must be recovered, especially in stressful phases such as these; it’s important to bring back the attention to the closest markets starting from the local ones. Being forced to stay in our local community , among other things, imposes this choice, but all this could become an added value in the near future both in consumption and in tourism. We have already experienced a similar phenomenon in 2001.

In general, what strategies do you think companies should follow once the

lockdown will be over?

Surely it will be necessary to review professional strategies, invest in technological innovation, create a customer relationship management system, work on smart working operational projects that foresee a decrease in travel and incentives for digital meetings. It will then be necessary to increase the safety protocols, following the regulations established by the Government. It will be necessary to focus attention on the product, which must be modern but capable of overcoming temporary trends and lasting over time. It will be necessary to interpret the concept of “comfort wine”, Feel good “,” emotion “” experience “, emphasizing the concreteness and safety of what you buy. The historical brands will have an important role in this kind of approach towards wine.

From a communicative point of view, the role of brand awareness will be central. It will be essential to have a good brand reputation. There will be a more genuine communication, with fewer masks and more faces. Digital tasting will be promoted to taste the new vintages at a distance, having the opportunity to receive the products directly at home.

A “tailor-made” concept for markets and customers will be recovered.

How do you imagine the future of sales reps in an increasingly digital era?

The figure of the sales rep will remain the protagonist and will have an evolution, he will be less and less a simple collector of orders and more and more a Brand Ambassador able to take care of relationships focusing on the human aspect, through advices, data, and direct personal relationships with the Horeca customers.

What proposals have the Italian restaurateurs made to the government?

The “Rete della Ristorazione Italiana” (Network of Italian restaurateurs), counting more than 26 business associations and 34.000 associates, developed these proposals in order to survive first and then start again full power to preserve the Made in Italy, its tourism, superb wineries, excellent food and more: cancellation of national and local taxes, credit for utilities related to commercial activities and payment plan without interest; extension until the end of the year of the extraordinary fund for employees that are not working right now; suspension of leases, mortgages and rentals until the end of 2020; easier access to credit; an extraordinary tax relief on the employees that are working, tax exemption on social security contributions and benefits up to June 30th 2021; possibility for the restaurants and bar to extend home deliveries; non-refundable support measures 4 for the mandatory closure period imposed by law by the covid-19 emergency (equal to 10% of turnover in relation to the same reference period): these are the measures requested from the world of Italian catering, unfortunately bended due to the crisis imposed by Coronavirus, which has already cost € 12 billion to restaurants, bars and clubs, that could reach 28 billion losses by the end of the year, according to Fipe.

How do you see the future of restaurants?

We are going forward between scenarios of uncertainty and strong disturbance for what we are experiencing. We must be concrete, try to see this moment as an opportunity for change. We must have the courage to change while remaining faithful to our identity, trying to fortify it.

What would be your strategy?

Authenticity, quality, safety, value of the territory. We need to make a strong and powerful system with all our sectors. Professionalism, innovation and tradition, value of the raw material will win. Capable entrepreneurs will make it, who always has worked well in the past will continue to do so and will be able to face the future with confidence. There will be more meritocracy and seriousness. Rebirth is possible.

In your opinion, what can be the “recipes” to encourage a recovery in the

restaurant sector?

An interesting proposal could be the “dining bonds”, an idea (which originally came from the United States) signed by the Dinnerbond.it portal. Many chefs from all over Italy joined the initiative; Cristina Bowerman, Luigi Taglienti, Cristiano Tomei, Lorenzo Cogo, just to name a few. A “tasteful” investment, but real: through the platform it will be possible to buy vouchers, at a price set by restaurateurs, which will be usable with a higher value, even doubled, when the premises can reopen. Food and wine delivery is ready to evolve. It is becoming a strong aspect for restaurants, pizzerias and bistros – the last businesses that can reopen at the end of the health emergency – which allows both to support themselves and to maintain a constant contact with their customers . Food and wine delivery still needs to grow, between strictly regulated takeaways and distancing rules, but also with increasingly articulated offers that do not forget the experiential side. This will make the market even more competitive: to differentiate, it will be necessary for restaurateurs to enrich the delivery with unique experiential aspects, especially for the top restaurants as to enrich the offer with a selected wine list for the perfect wine pairing with their menu and make available, for special occasions, cook and waiters, sommeliers and barmen (in full compliance with the sanitary rules).

What would you recommend to a young man who works in the wine sector in the restaurant field?

I would say what I always repeat to my son Ferdinando, almost 18 years old. Beneath success there is a lot of effort, nothing in life is given. We must study and be prepared. Having curiosity to learn and discover, not to be afraid of thinking about new goals. Have the humility of the neophyte but the courage of a great explorer. Do not homologate to others. Never! Stay free, independent and always have the courage of your choices even when they may seem against the common thinking.

How do you imagine the restaurant of tomorrow?

Obviously, we will have to follow the safety and health instructions given by the authorities; at the level of new proposals, I would recommend greater seasonality in the menus, more creativeness and with menu proposals that can change every month. I imagine a short supply chain that can reward small production agricultural companies; I imagine a 100% Italian cuisine reinvented in a modern way. We have an incredible variety of agricultural products in Italy, we have many PGI of oil production, DOC and DOCG of great value, a selection of dairy products.

Let’s rediscover our Italian traditions, let’s rediscover our territories and we can create a new way of offering ourselves in a modern way, with a strong territorial identity. As I often mentioned in several interviews abroad, even spaghetti with tomato sauce made with excellent raw materials are a great dish. We can rediscover the elegance of simplicity but made with great skills. We can take inspiration from classicism, from art and from what it has made our country great. As per the location, I imagine the return of large open spaces, new areas reconverted and temporary restaurants. Maybe halls of public buildings leased temporarily for gastronomic experiences. Food and culture…

In the wider global context, many hospitality businesses have stopped doing business altogether for now. For those continuing to trade, the new reality is that they must largely focus their efforts on delivery and takeaway. To make that succeed and keep revenue going, clever marketing is essential. This means tailoring your tactics to adjust to the new reality, rather than employing all the usual methods.

And recently Conor Ward of www.flipdish.com published a recommendation; a range of strategies for managers and owners to consider, which could help to maintain sales and business profile during this challenging period.

In all sorts of circumstances, but especially in a time of crisis, strong and clear communication is vital.

“One of the best ways to overcome the current fear and uncertainty is to communicate. People like to know what’s happening, as we all like to be reassured. It’s important to take the lead on communication to your customers, so they are informed from the right sources. Your customers want to know that you’re on top of this situation, so let them know.”

You can reassure your customers that you’re dealing with the crisis through digital channels, such as social media, simple emails, text message notifications and joining competition to market your product at reasonable price. Join Singapore Taste Awards now here and get importers and distributors.

With on-site trading no longer possible for many, we recommended the promotion of delivery and takeaway options. “That’s really what consumers want right now.

With people now largely confined to their home for days and weeks, we advised focusing on current societal trends and consumer habits, such as binge watching Netflix shows while enjoying their favourite food – clearly not an entirely new trend, but certainly more popular in the current climate!

This presents an opportunity for restaurants offering delivery, as promotions can be built around these trends, such as tying in with popular shows or offering all-day deals to keep things very relevant.

One positive aspect to emerge from this crisis, despite the physical distancing measures that are in place, is the sense of community spirit resulting from everyone being in this struggle together.

Some restaurants have reached out to help in their communities, by providing food to local hospitals and frontline workers. This certainly puts our industry in a positive light, contributing and being at the heart of these efforts. This can generate a huge amount of goodwill among customers, both for now and beyond this crisis.

There’s absolutely no denying that this crisis presents a huge challenge for the hospitality sector all over the world. The coming weeks and months are sure to bring great difficulty for many businesses.

However, there are some practical things you can do to stay on track during the crisis, and a little creativity could go a long way. You may even find that digital strategies and developing the online side of your business opens up new opportunities for growth. Ultimately, it is possible to overcome this challenge and continue thriving well into the future.

The most important thing for wine businesses to do right now is to remain calm, clear and focused on what their business needs to do in terms its emergency plan, stabilization plan and recovery plan, according to Wine Business Solutions. Involving employees in finding solutions is the biggest single determinant of success, in terms of business survival in a crisis.

List of recommendations for alcohol manufacturers :

IRI MarketEdge identifies three key areas for wine (and other alcohol) businesses to focus on in the short term: sticking to core products, diverting resources to online and doing good.

For direct marketing, joining a competition to market your product is one of the easiest way. Join Singapore Wine Awards now here and get importers and distributors.