Jessica (Cellar.asia) is a wine specialist based in Tuscany recently published Singapore Wine Industry: The insider’s picture

The Singaporean wine sector is highly developed and competitive, and according to the ProWein Business Report 2019, Singapore is the number one emerging market for producers to enter over the next five years.

Six Southeast Asian countries claimed the top 10 as emerging sales markets for producers and exporters, Vietnam (5th, 21%), Thailand (7th, 15%), Malaysia (8th, 12%), Philippines (9th, 11%), and Indonesia (10th, 10%) are all represented.

With Singapore positioned as the gateway to the Southeast Asian wine business, this modern city-state is an exciting market opportunity to investigate.

Essential information on the Wine Market in Singapore

Singapore does not produce any of its wine and is an import reliant market. This wine industry is driven by powerful consumer spending and intense urbanization.

The high disposable income of locals drives the appeal for premium wine. Singaporeans are some of Asia’s biggest spenders on eating and drinking out, therefore Singapore’s trade policies are focused on ensuring a steady supply of high-quality foreign wine into the market.

International winemakers control a significant share of the market in Singapore, capitalizing on the lack of domestic winemakers in the nation.

Singapore is a multicultural country with English as the primary working language and a population of almost 6 million people which is growing quickly.

Circa 74.3% of the inhabitants are Chinese, 13.4% are Malay, and 9% are Indian (2017 est.).

The whole Southeast Asian region is made up of around 40 % of practicing Muslims, which makes the industry difficult to penetrate, this means that growth is limited to three consumer profiles: visitors, expatriates, and the other 60% of the Southeast Asian population.

Singapore is the top emerging market of choice for international wine exporters. One of every two producers from France (49%), Italy (51%), and Spain (45%) list Singapore as their choice of emerging market for 2020. 32% of New World wine exporters also list Singapore as a potential market prospect.

Top countries by import growth from the world:

| 1. United States | +1,412 million USD |

| 2. China | +1,145 million USD |

| 3. Germany | +664 million USD |

| 4. France | +570 million USD |

| 5. United Kingdom | +469 million USD |

| 6. Singapore | +312 million USD |

| 7. Italy | +289 million USD |

| 8. Belgium | +246 million USD |

| 9. Poland | +219 million USD |

| 10. Netherlands | +169 million USD |

| 11. Hong Kong | +161 million USD |

| 12. Sweden | +160 million USD |

| 13. South Korea | +148 million USD |

| 14. Denmark | +146 million USD |

| 15. Ukraine | +117 million USD |

Average annual growth 2018/2017: +8%

Wine Consumption in Singapore

By 2021, if Prowein’s estimations are correct, the wine market in Singapore will reach a market value of US$1.4 billion, registering an average wine consumption of four bottles per capita.

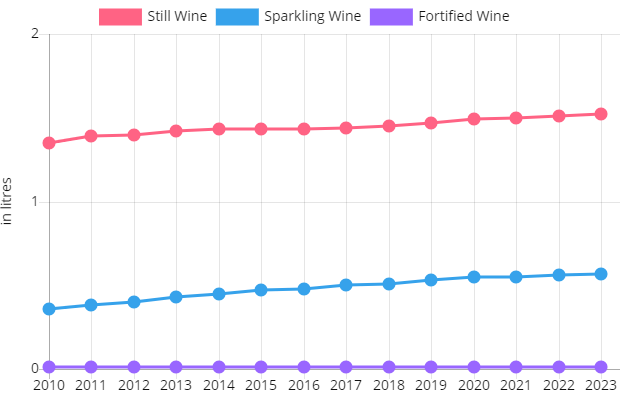

Currently the average consumption of wine per capita in Singapore today is around 2 liters, which equals two and a half bottles. By 2021, that number should reach almost four bottles.

Average Volume per Capita, in litres

How do the sales of different international wines compare in Singapore?

France dominates the premium wine market, closely followed by Australian wines and Chilean wines.

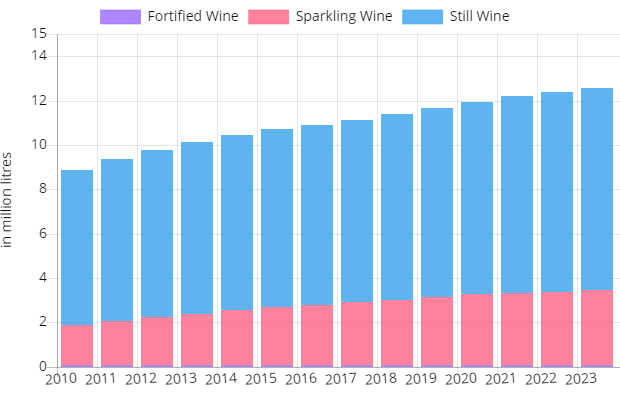

Still wine is the most popular wine imported into Singapore, followed by sparkling. Prosecco is rising in popularity as consumers look for a cost-friendly alternative to French Champagne. Singaporean wine consumers are knowledgeable and willing to try new tastes.

The top five brands of still wine in Singapore are all Australian wine brands. They include Jacob’s Creek; the biggest brand in terms of overall wine volume sales.

The fortified wine category registered the slowest value growth. This sector is expected to grow at a lower CAGR of 3.2% from 2016 to 2021. Consumers within this category are less likely to trade-up to premium offerings, so manufacturers charging premium prices will need to thoroughly justify it to the consumer.

Volume, in million litres

Price per liter of wine imported into Singapore

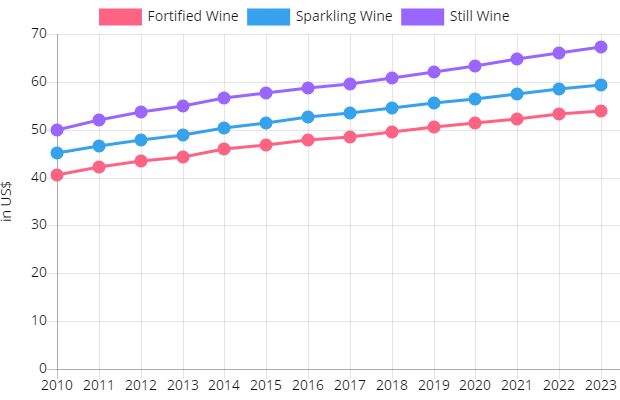

The average price per unit of wine is US $61.49 for still wine and $56.50 for sparkling wine.

Price per Unit, in US$

How is wine distributed in Singapore?

Market growth is likely to come first and foremost from online wine merchants.

Data from research agency Euromonitor International found that Internet retail continued to be the fastest-growing off-trade channel for wine in Singapore in 2017. It also predicted the trend is likely to remain with major online retailers likely to appeal to a tech-friendly consumer base seeking competitive prices and uncomplicated purchases.

Wine bars are popular with expats and visitors and are complemented by Asia’s rising middle-class interest and enthusiasm for wine culture and eating out.

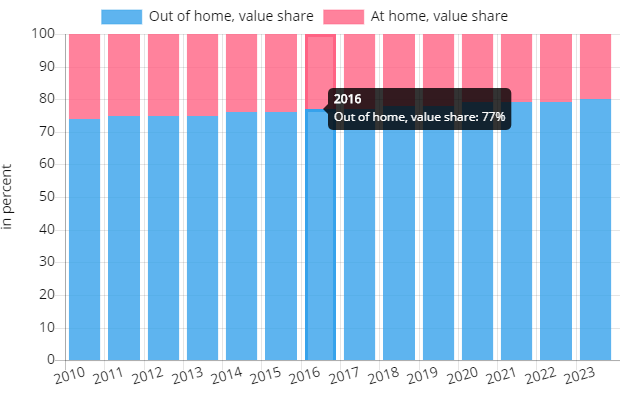

According to Statista, by 2023, 80% of spending in the wine industry will be attributed to out-of-home consumption.

Out of Home Revenue Share

Limiting factors

Despite many wine specialists touting Singapore as an emerging wine player, it is also a very tight and cutthroat market. The consumer base is limited, and there are already many well-known importers, suppliers, and sellers with excellent reputations.

Singaporeans are loyal and cautious towards exploring replacements to their usual wine preferences. They enjoy new products, but also stay faithful to well-known brands and like to experiment with new products only after feeling guaranteed of their quality and origin.

Singapore imposes heavy taxation on alcoholic beverages, otherwise known as the ‘sin’ tax. Marketing of wine is restricted, and alcohol advertisements are not permitted to be shown during programs intended for young people or during Malay-language tv shows.

What are the current market trends and suggestions in Singapore?

Singapore is home to the Southeast Asian region’s largest wine storage vault and is increasingly being regarded as Asia’s most innovative wine hub. By virtue of its strategic location on the world’s major trade routes, Singapore is the world’s busiest container transshipment nucleus and is an exciting gateway into the Southeast Asian wine market for longstanding collectors and new enthusiasts alike.

The country presents significant growth potential due to the mounting trend of accumulating vintage wines which are also assisting the growth of the sector.

Premium consumers from countries such as Myanmar, Vietnam, Laos, China, and South Korea prefer to purchase premium high-end wines from Singapore because they feel that what they purchase in their own markets may not be authentic.

Foreign winemakers should look to take advantage of this premiumization undertaking by introducing luxury premium wine products into the market.

There is a growing demand for healthy and sustainable wine products as the average Singaporean enjoys a high standard of living and is a keen buyer of high-quality products. This is interesting to organic wine producers looking to enter the market.

Singaporean wine consumers are open-minded and have a high disposable income that they are willing to spend on liquid luxury products such as wine.

Pricing should be competitive, as bargaining is commonplace in Southeast Asia.

Singapore is rebranding itself as a sophisticated wine hub for the new decade. This concept fits in very well with the city-state’s strategic location in the center of Southeast Asia and it’s excellent transportation links. Emerging market players should keep in mind factors such as price, quality, and service and remember that the market is both small, and competitive.